CICI Bank Personal Loan Interest Rates and Features

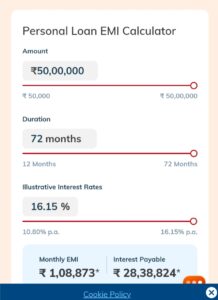

ICICI Bank offers competitive interest rates on personal loans, starting from 10.80% per annum and going up to 17.99% per annum depending on various factors like the applicant’s credit score, income stability, and relationship with the bank【7†source】【8†source】【9†source】.

Key Features and Benefits:CICI Bank Personal Loan Interest Rates and Features

1. **Loan Amount**: You can avail of a personal loan of up to Rs. 50 lakhs.

2. **Interest Rates**: The rates start at 10.80% per annum and can go up to 17.99% per annum.

3. **Processing Fee**: Up to 2.50% of the loan amount plus GST.

4. **Tenure**: Flexible repayment tenure ranging from 12 to 72 months.

5. **Prepayment Charges**: No prepayment charges if the loan is closed using own funds (for MSME customers); otherwise, 5% of the remaining principal amount plus GST.

6. **Late Payment Charges**: Additional interest of 24% per annum on late payments.

7. **No Collateral Required**: Personal loans from ICICI Bank do not require any collateral【7†source】【9†source】.

Bajaj Finance Personal Loan: Everything You Need to Know

Eligibility and Documentation:CICI Bank Personal Loan Interest Rates and Features

To apply for a personal loan, you need to provide:

– Proof of identity (e.g., Passport, Voter ID, Driving License)

– Proof of address (e.g., Utility bill, Passport)

– Bank statements for the last 3-6 months

– Salary slips for the last 3 months (for salaried individuals)

– Income proof and audited financials for the last 2 years (for self-employed individuals)【9†source】【10†source】.

Application Process:CICI Bank Personal Loan Interest Rates and Features

1. **Online Application**: Fill out the application form on the ICICI Bank website or mobile app.

2. **Document Submission**: Upload the required documents online.

3. **Approval and Disbursal**: If all documents are in order, approval can be instant, and the loan amount can be disbursed within 72 hours【8†source】【10†source】.

Additional Features:CICI Bank Personal Loan Interest Rates and Features

– **EMI Calculator**: Use the ICICI Bank EMI calculator to estimate your monthly installments based on the loan amount, interest rate, and tenure.

– **Balance Transfer**: Transfer your existing personal loan balance to ICICI Bank for potentially lower interest rates after paying 12 EMIs.

– **Top-up Loans**: Existing personal loan customers can apply for a top-up loan based on their outstanding balance【8†source】【10†source】.

For more detailed information and to apply for a personal loan, you can visit the [ICICI Bank Personal Loan page](https://www.icicibank.com).