Best(7) bank home loan Indian bank home loan

HOME LOAN HOME LOAN PROCESS HOME LOAN INTEREST RATES BEST HOME LOAN SBI HOME LOAN HOME LOAN ELIGIBILITY HOME LOAN EMI HOME LOAN KAISE LE HOME LOAN INTEREST RATE HOME LOAN CALCULATION METHOD HOME LOAN IN TELUGU HOME LOAN INTEREST HOME LOAN PREPAYMENT HOME LOAN DETAILS IN TELUGU LATEST HOME LOAN INTEREST RATE OF ALL BANKS BEST BANK FOR HOME LOAN HOME LOAN INTEREST RATES TELUGU HOME LOAN INTEREST CALCULATION HOME LOAN INTEREST RATES EXPLAINED

- SBI Home Loan. 8.05%-8.55% …

- HDFC Home Loan. 8.60% – 9.50% …

- Axis Bank Home Loan. 7.60% – 8.05% …

- ICICI Home Loan. 8.40% – 9.45% …

- Bank of Baroda Home Loan. 7.45% – 8.80% …

- PNB Home Loan. 8.25% – 11.20% …

- LIC Housing Finance Home Loan. 8.00% – 9.25% …

- Aditya Birla Home Loan. 8.00% – 13.00%

(1)SBI Home Loan

SBI Home Loans offers a one stop solution to a home buyer. You can browse through our range of home loan products, check your eligibility and apply online

SBI Home Loans is the largest Mortgage Lender in India, which has helped over 30 lakh families to achieve the dream of owning a

(2) Home Loan – Apply Housing Loan Online upto ₹5 Cr*

ICICI Bank offering Home Loan up to Rs. 5 Crore* online with a competitive interest rate @ 8.75%* p.a. (applicable only to customers with Pre- approved Home Loan …

Home Loans

simplified

- Home Loan Online of up to ₹ 5 Crore*

- Instant Provisional Sanction

- Digital Application Process

- Minimal Documentation

- Apply now

(3) Apply for Home Loan Upto Rs 5 Crore

Axis Bank Home Loan: Apply for Home Loan Upto Rs 5 Crore at attractive interest rates. Get Housing Loan upto 30 years to make your dream home with easy…

Home Loan

Fulfil your dream of owning a home with Axis Bank Home Loan which offers housing loans starting at Rs 3 lakh. The Axis Bank Home Loan comes with a host of benefits such as smaller EMIs where you can space out your payment over a longer tenure, attractive interest rates, an easy application process, doorstep service, etc. Find out more about the Axis Bank Home Loan now.

(4) Apply Home Loan Online | Housing Loan at EMI of ₹787*/ Lakh

HDFC Home Loan: Get a hassle-free home loan with affordable rates, documentation, and charges for your dream home. Apply online now.

Home Loan

At HDFC Bank, we understand that a home is not just a place to stay. It is much more than that. It is a warm little corner of the world that is yours, tailored to your tastes and needs. It is the place where you celebrate the joys, deal with the sorrows and enjoy the journey called life. There is no place like home and with HDFC Bank Home Loans you can gather hopes, achieve your dreams and create memories in your own space.

(5) Apply Home Loan of up to Rs. 10 Cr* at 8.85%* p.a Online

Apply for Home Loan online at IDFC FIRST Bank up to Rs. 10 crore* with minimal paperwork & Interest rate starting at 8.85%* p.a. Get quick approval & repay

Home Loan – Apply for Housing Loan Online

Getting a home is now easier than ever. With IDFC FIRST Bank home loans, we give you the best interest rates on housing finance and a wide selection of property options, so that you can live your best life. Apply for a home loan online and avail of a higher loan eligibility and the flexibility to repay it over 30 years.

(6) Home Loan Products and Services – Get the Best Rates

Find best home loan products & services that suit your needs & budget. We offer a range of home loan options at low-interest rates with flexible repayment …

Baroda Max Savings Home Loan

- Under the scheme, the borrower has the option to deposit all his savings in the linked SB account to avail maximum benefit of interest in the Home Loan account.

- Loan Amount: Maximum 20 crores

- Maximum Tenure: 30 years

- Apply now

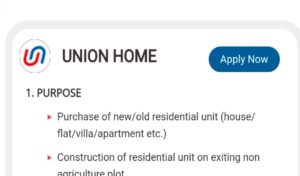

(7) Housing Loan in India | Know about Home Loan Policy | UBI

Learn more about Home Loan and how to apply house loan in bank also get to know the Home loan interest rate with Union Bank of India.

1. PURPOSE

► Purchase of new/old residential unit (house/ flat/villa/apartment etc.)

► Construction of residential unit on exiting non agriculture plot.

► Purchase of non-agricultural plot and construction of residential unit (composite project) thereon**

► Repairs/improvements/ extension of the existing residential property.

Take-over of housing loan availed from another bank / FI

► Completion of under construction residential unit.

▸ Purchase of solar power panel along with purchase/construction of house.

What are mortgage loans? (Loans against Property)

Mortgage loans are most commonly referred to as loans against property in India. It can be availed by both salaried and self-employed individuals to fulfil various personal or business-related needs. As the name suggests, this loan requires the mortgaging of property. In simple terms, a mortgage loan is available by pledging one’s property.

Mortgage loans are generally available at interest rates ranging from 8.15% to 11.80% p.a. The amount of loan one can avail is normally up to 60% of the registered value of the property. Some banks offer up to Rs.10 crores in mortgage loans provided certain pre-conditions are met. The maximum repayment tenure for mortgage loans is generally around 15 years.

Sure, here’s a detailed article on home loans that covers various aspects:

Bajaj Finance Personal Loan: Everything You Need to Know

CICI Bank Personal Loan Interest Rates and Features

Home Loan Calculator App: Plan Your EMI and Loan Amount with Ease

Home Loan Calculator App: Plan Your EMI and Loan Amount with Ease

Home loan kaise le: How to Get a Home Loan: A Comprehensive Guid

home loan

home loan interest rate

best home loan

best bank for home loan

sbi home loan

sbi home loan interest rate

loan,home loan kaise le

best bank for home loan 2024,hdfc home loan,cheapest home loan,instant loan,bank of india home loan,home loan process,home loan emi,home loan interest rates,icici home loan,hdfc home loan interest rate,home loan interest rates 2023,best loan app