The State Bank of India (SBI) is one of the main public area banks in India, offering serious home credit loan fees for borrowers. Starting around 2024, SBI gives an assortment of home credit plans taking care of different necessities like buying a house, building a home, or revamping a current property.

Key Features of SBI Home Loan Interest Rates

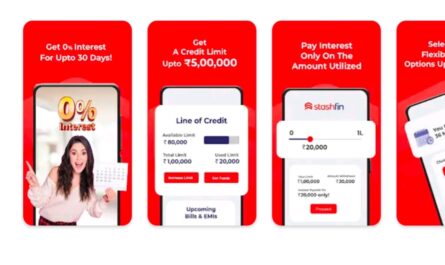

Personal Loan for Salaried & Self-Employed, Instant Business Loan | Credit Score

Serious Rates: SBI offers financing costs beginning at 8.40% per annum (dependent upon future developments in view of RBI strategies and monetary circumstances).

Rate Type: The loan fees are connected to the Repo Rate Connected Loaning Rate (RLLR), making them dynamic and market-driven.

Advance Residency: Borrowers can profit of adaptable reimbursement terms as long as 30 years, lessening month to month EMIs.

Handling Charges: Negligible or here and there postponed for limited time offers.

Unique Rates: Limits for ladies borrowers, who get particular rates under unambiguous plans.

Factors Influencing SBI Home Loan Interest Rates

Financial assessment: A higher CIBIL score (750 or more) guarantees lower loan fees.

Credit Sum: Rates might differ in light of the chief sum.

Work Type: Salaried people could get somewhat lower rates contrasted with independently employed people.

Credit Residency: More limited residencies might have better rates.

Instant personal loan for Home Credit customers | Easy Process | 100% paperless

SBI Home Loan Schemes

SBI Standard Home Credit: For general home-purchasing purposes.

SBI Honor Home Credit: Customized for government representatives.

SBI Shaurya Home Credit: Extraordinarily intended for guard faculty.

SBI MaxGain: Offers an investment funds connected choice.

SBI Green Home Credit: For eco-accommodating lodging projects.

Phool (Flower) Art: A Beautiful Cultural Expression

Blossom workmanship, or Phool Craftsmanship, is an immortal articulation of inventiveness that changes fragile sprouts into shocking visuals. From decorative layouts to rangoli-style designs, phool workmanship tracks down its underlying foundations in conventional practices while flourishing in contemporary plans.

Cultural Significance

Celebrations and Festivities: Blossoms are essential to celebrations like Diwali, Onam, and Pongal, where they are utilized to make brilliant examples (pookalam).

Weddings: Many-sided botanical settings and laurels represent love and success.

Strict Practices: Flower designs in sanctuaries and petitioning heaven rooms add a heavenly quality.

Credit Line & Personal Loan App with flexible tenure and quick disbursal

Forms of Phool Art

Botanical Rangoli: Orchestrating petals in complex mathematical or emblematic plans.

Bouquet Configuration: Joining various roses for tasteful allure.

Laurels: Utilized in customs, festivities, and as enlivening embellishments.

Drifting Petals: Set in water bowls, improving atmosphere.

Modern-Day Applications

With the ascent of eco-cognizant living, phool craftsmanship is progressively being taken on in feasible practices:

Biodegradable Adornments: Utilization of blossoms rather than manufactured materials.

Studios and Rivalries: Educating phool workmanship methods to fans.

Conclusion

Whether in banking through SBI’s home advances or in the sensitive excellence of phool craftsmanship, India mixes custom with innovation. From monetary development to social articulations, these two features feature the nation’s variety and advancement.

1Loan==

2Loan==

3Loan==

4Loan==

5Loan==

6Loan==

7Loan==

8Loan==